Courses

IIM ROHTAK

IIM KASHIPUR

IIM RAIPUR

IIM VISAKHAPATNAM

IIM SHILLONG

IIM Jammu

IIM Bodh Gaya

IIM Ranchi

IMI Bhubaneswar

About Us

Career

eMBA

F.A.Q's

Corporate Learning

Refer & Earn

Success Stories

NuCorp

IIM ROHTAK

IIM KASHIPUR

IIM RAIPUR

IIM VISAKHAPATNAM

IIM SHILLONG

IIM Jammu

XLRI

IIM Bodh Gaya

IIM Ranchi

IMI Bhubaneswar

Finance

eDP in Applied Financial Risk Management Admission Open eDP in Financial Data Analytics Admission Closed

Executive Development Programme in Applied Credit Risk Analytics

Executive Certificate Program in Applied Credit Risk Analytics with IIM Kashipur quantification has emerged as a very important component of a firm’s financial well- being. This course provides training on the usage of tools used in the quantification of credit risk and problems related to credit risk management.

IIM KASHIPUR

4 Months

COURSE DURATION

1ST

BATCH

11th August - 2019

DATE OF COMMENCEMENT

Blended Learning

ONLINE SESSIONS & CAMPUS VISITS

Batch Intake

50 Candidates

Course description

About the Course

Executive Certificate Program in Applied Credit Risk Analytics with IIM Kashipur India is a blended learning program of 3.5 months duration. Learn about the newest trends and tools from India’s top-notch faculty and Industry Mentors.The course will extensively make use of MS Excel mainly and for some models R will be used.

Understand the basic statistics required in credit risk analysis.

Understand the credit scoring approaches used in practice for different firms.

Understand the implementation of Credit Metrics approach to estimate the VaR of the non- tradable loan portfolio.

Understand the models to estimate probability of default for credit profile evaluation of a firm.

Understand the models to estimate loss given default (LGD), exposure at default (EAD) and expected credit loss.

Key Highlights

CERTIFICATION FROM IIM KASHIPUR

CASE-BASED SESSION

INDIA’S TOP FACULTIES

CAMPUS VISITS

WEEKEND CLASS SCHEDULE

INSIGHTS INTO APPLIED CREDIT RISK ANALYTICS

SESSIONS FROM INDUSTRY EXPERTS

Course description

Who Should attend & Course Pedagogy

Professionals who are looking to upgrade their career in Finance.

Entrepreneurs/Finance Heads & Leaders, Coordinators and Team Members

Working professionals in an organization with an acumen and interest in Applied Credit Risk Analytics.

Eligibility

- Graduation or equivalent degree from any recognized University or Institute

- Working Professionals with a minimum of 2 years of experience

- Corporate Nominated (graduation criteria maybe considered for exemption in cases where participants have some prior experience in the respective domain).

- On case-to-case basis less experience can be considered.

Course Pedagogy

The form of delivery will be Blended (Campus, Self space and online), with 2 days workshop and a final examination should be conducted by the Institute at the end of the course. All the sessions will be conducted through the digital platform and delivered LIVE by the eminent faculty of IIM Kashipur.

Assessment

| End-Term Exam | 60% |

| Assignment | 20% |

| Quizes | 20% |

Assignments, Videos & Case Studies

Curated Course Syllabus

Basics of Credit Risk

- Exploratory Analysis

- Empirical Distribution

- Location measures

- Dispersion measures

- Third and fourth moments

- Joint empirical distribution

- Correlation, Sampling

- Hypothesis testing

- Descriptive statistics.

Credit Scoring Models

- Logit Model for Loan Default Analysis (both individual and corporate loan)

- Decision Tree for Loan Default Analysis

- Altman Z Score (For Manufacturing Firm)

- Credit Scoring Models for Private Firm

- Non-Manufacturing Firm and Indian Firms

- Behavioral Scoring

Credit Metrics

- Credit VaR for Non-Tradable loans

- Credit Ratings and Rating Transition Matrices

Probability of Default Models (Discrete Time Hazard Models)

- Linear model

- Probit

- Logit

- Complementary log-log model PIT (Point-in-Time) and TTC (Through-the cycle) estimates

Probability of Default: Structural (Merton) model of default, Moody's KMV

Reduced form model for probability of default

- LGD Estimation: Key concepts in default handling: clients, default,

- Collateral and exposure; Non performing loans management

- LGD model methodologies; Application: uses of LGD

- Exposure at Default: Regulatory perspective on EAD, EAD

- Modelling: Credit Line Models.

- Expected and unexpected credit loss.

Default correlation and Credit Portfolio risk

Bayesian Approach to Credit Risk modelling, Survival Analysis, Correlation estimation with Bayesian Statistics

Credit Derivatives: Credit Default Swap, Securitization

Low Default Portfolio

IFRS 9, Brief BASEL I, II and III from the perspective of Credit Risk, Regulatory and Economic capital (basic idea)

Program Fees

For Indian Residents

Rs.60000 + GST*

Tenure

Deadline

Amount (INR)

1st instalment

Immediate Payment

Rs. 20000 + GST*

2nd Instalment

10 August 2019

Rs. 20000 + GST*

3rd Instalment

10 September 2019

Rs. 20000 + GST*

For International Students

USD 1400

Kindly Note : Campus visit will be over and above of program fee.

* EMI dates may vary on a case to case basis. For more information, please refer the welcome email sent to you after the registration.

* EMI dates may vary on a case to case basis. For more information, please refer the welcome email sent to you after the registration.

* Loan option available in 6, 9 & 12 EMIs from loan partners.

* 1% + GST* processing fees will be charged by loan partner in 6/9/12 months EMI.

* 1% + GST* processing fees will be charged by loan partner in 6/9/12 months EMI.

Course Certificate

Earn Certification After The Successful Completion Of The Course

Click to enlarge

Testimonials

Experience of our Alumni

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

Rakshit Pophali

I started my data science journey with the guidance of The Scholar. The mentors from The Scholar taught me tableau, python and data science. The mentors from The Scholar are with full of knowledge and technical hacks. They made me learn how to solve every difficult as well as technical question with easy approach. I would recommend The Scholar for a great and exciting journey. And at the end I would say the assistance what I got from The Scholar placement team for Resume building, LinkedIn account enhancements and also how to use the job portals effectively led to an amazing placement which I was never expecting. Thank you for all the hard work.

KISHORE KUMAR B.R

Accounting Section Manager/PARAMETRIC TECHNOLOGY INDIA PVT LTD

I had the best online learning experience with Nulearn. Team is very helpful & proactive whenever their assistance was needed. Dilip Kumar Sir is very supportive, before starting the session he always does the revision of previous session, so that we could recollect and have better understanding. Nulearn has surely made upskilling easy and approachable for working professionals. Overall, a great learning journey, will surely be recommending this course to my fellow professionals. KUDOS TO ENTIRE TEAM!

Suyash Srivastava

HR Advisor - Autodesk India Pvt. Ltd.

The campus visit was awesome, it was an absolute pleasure to be sitting at the campus and experience live sessions by the esteemed faculty of IIMs. Overall a wonderful experience.

About the institute

IIM KASHIPUR

- The Institute is set up with the objective of providing quality management education while sensitizing students towards the needs of the society.

- The faculty at IIM Kashipur represent the best mix of academic and industrial experiences.

- The Institute is located in one of the most densely industrialized regions in the country with over 180 industries having plants in and around the region. This places the Institute at a vantage point when it comes to ‘Learning by Doing’ via frequent industry interactions and live projects.

- The rigorous curriculum seeks to instil a passion for knowledge and ability to apply that knowledge to real life scenarios.

The flagship programmes of the institute are Master of Business Administration (MBA) and Master of Business Administration (Analytics) which are full time, two-year residential programmes. The rigorous educational curriculum tries to ingrain an enthusiasm for learning and the capacity to apply that information to real-life scenarios. The programme lays accentuation on all-round personality.

The institute also offers a two-year weekend Executive Master in Business Administration (MBA-WX) for working executives. Doctoral Programme – PhD and Executive Fellow Programme (EFPM) are the two doctoral programmes launched in 2015 and 2014 respectively. The faculty at IIM Kashipur represents one of the best mixes of academic and industrial experiences.

The 200-acre campus spreads loudness and cheers in the serene town of Kashipur, nested in the lap of Himalayas. The vibrant youth converging from across the country has lent life to and energized the beautiful campus. The institute brags of being situated in one of the densest industrialized districts in the nation with more than 180 ventures that have set up their plants in and around the region. This places the institution at a vantage moment when it comes to ‘Learning by Doing’ through regular industry interaction and live projects.

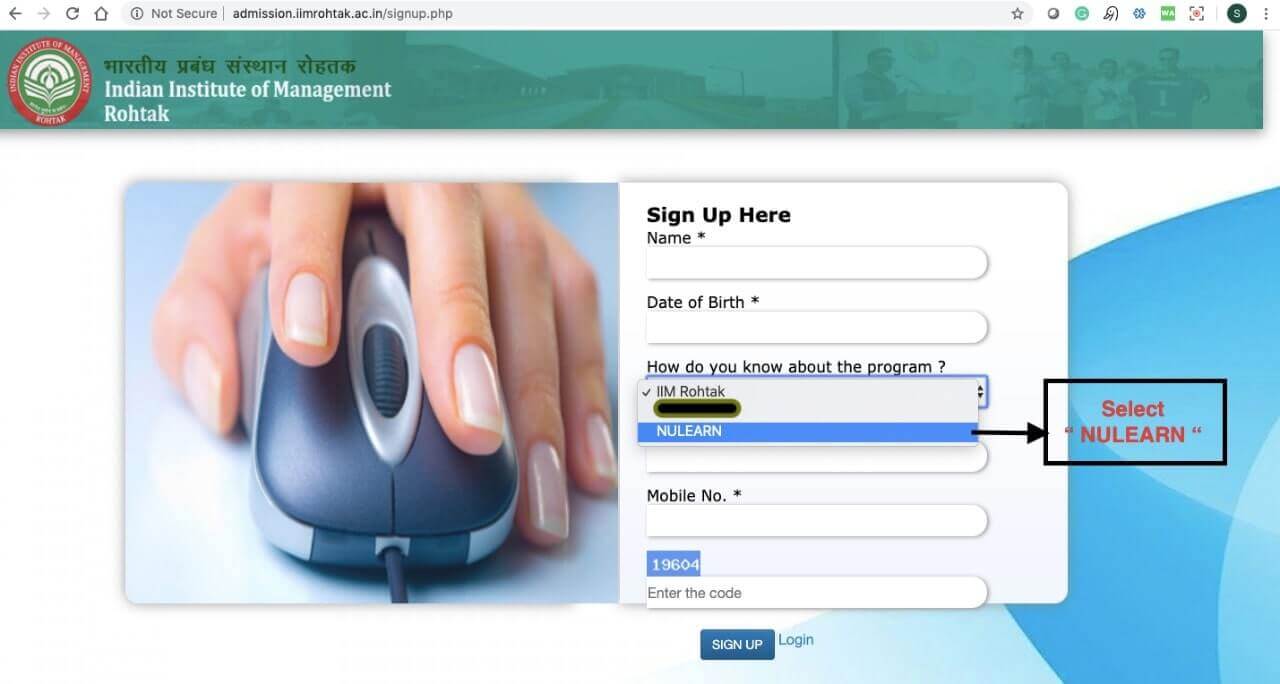

Start Your Application

-

I have read the details and eligibility criteria for admission to the program, that I am applying for.

-

I understand that my application shall be considered complete only when the Application fee along with required documents are received by IIM Rohtak and all mandatory fields in the application form are completed.

-

I understand that merely submitting the application form and fee, does not entitle me for the admission to the Diploma programme The admission is purely on the basis of my profile scoring, qualification and further evaluation by the Institute.

Career Assistance

Corporate Prices / Plans

No. of Nomination

Discount

2 to 5

5%

6 to 10

7.5%

11 to 20

10%

21 and above

Contact the team

EMI Options / Plans

Partner

Tenure

EMI

1 Month

Rs. 60000 + 18% GST

3 Months

Rs. 20000 + 18% GST

9 Months

Rs. 5852 Monthly

12 Months

Rs. 4472 Monthly

Please Note

-

Processing Charges may be applicable as per bank rules.

-

No loan facility is available for foreign students.

Register Now

give your career a boost

Relevant Courses

Admission Open

eDP in Applied Financial Risk Management

Certified by

IIM KASHIPUR

Duration

5 Months

Admission Closed

eDP in Financial Data Analytics

Certified by

IIM KASHIPUR

Duration

5 Months

Admission Closed

Executive Certificate Program in Business Finance

Certified by

IIM RAIPUR

Duration

5 Months

Admission Closed

eDP in Valuation, Fundamental and Technical Analysis

Certified by

XLRI

Duration

5 Months

Company

About Us Career Saturdays With Sumit Media Coverage Blog Testimonials Masterclass Testimonials NuInitiatives Contact F.A.Q.s Privacy Policy Terms & ConditionsNew Batches

Strategic HR Analytics Strategic Management Advanced Supply Chain Management & Analytics Executive MBA Analytics IIM Kashipur Executive MBA IIM Shillong Operations Management with Six Sigma IIM Kashipur Leadership and Change Management IIM Ranchi Valuation, Fundamental and Technical Analysis XLRI Advanced Project Management IIM KashipurContact

For Sales Enquiry: connect@nulearn.inFor Marketing/PR Enquiry:

marketing@nulearn.inCall Us:7669629222

Head Office Address:Human Racers Advisory Pvt Ltd, B1/638 A, 3rd Floor, Janakpuri, New Delhi - 110058

Branch Office:Plot 23, Sector 18 Maruti, Industrial Development Area, Gurugram, Haryana - 122015